As a new investor, I remember when I first began to learn about Gold investing.

It was very confusing and frustrating. Frankly, I was not even aware of the Pros and Cons of the different ways of Gold investment.

And in this detailed but simple guide, I will show you available Gold investment options along with their respective advantages and disadvantages. At the end of the guide, I will share my number one choice for gold investment.

So, what are the ways one can invest in Gold?

There are only five ways to make a Gold investment in India. But, before putting our hard-earned money in Gold as an investment, Let’s dig deeper into each investment option and know its Pros and Cons. Here are the five ways to invest in Gold.

#1 – Physical Gold such as Jewellery, Coins or Bars:

And rightly so, because the price of gold has risen phenomenally over time. But the question is that whether buying physical gold is the best way of investing in gold or not?

Here are the best things about investing in physical gold:

Pros of Physical Gold:

- Gold jewellery has traditionally been used to indicate social status and has a high sentimental value attached to it.

- You can also use it to get a gold loan.

- Further, there is no cost involved in storing gold physically for hundreds of years.

- Moreover, no paperwork is necessary for investment in physical gold.

- You don’t need a Demat account to invest in physical gold.

Cons of Physical Gold:

Here are the weaker parts about Physical Gold:

- High purchase cost due to making charges makes it unsuitable for investment purposes.

- Further , there is purity risk and storage risk.

- Moreover , taxes are levied on purchase and sale, reducing the return on investment.

- Normally, the Jewellers, pay less than the market price in case of buyback, and banks and other financial institutions do not offer buyback.

- And lastly , there is a risk of theft and burglary if you keep the gold with yourself.

#2 – Digital Gold from platforms such as Paytm, G-Pay, etc. :

Now that everything is digital, you can buy gold online and have it stored by the seller in an insured vault. But did you know that only three companies are authorized to sell digital gold in India?

Have you heard of these three companies? These companies are

But you must have seen websites and apps like Paytm, G-pay, Groww etc., selling digital gold. However, these apps only provide a platform to buy digital gold on behalf of above companies and may get a small commission.

So what are the advantages of buying digital gold? Let us find out:

Pros of Digital Gold:

- There is no purity and storage issue.

- You can get physical gold by paying delivery and making charges, or you can sell it for cash also.

- Further, you can use it as collateral for online loans.

- Moreover, you can start investing in digital gold with a small investment. For example, Google Pay allows you to invest even as little as Rs. 1.

Cons of Digital Gold:

- There is no official government-run regulator body such as RBI or SEBI to keep a watch on the companies selling digital gold. Due to this, there is always an associated market risk.

- Different types of expenses or taxes such as 3% GST on purchase, 3% storage and insurance expense and capital gain tax are levied on the sale of digital gold. These expenses reduce the overall return on investment.

#3 – Gold Mutual Fund :

In “Gold Mutual Fund”, the fund manager invests in shares of a company engaged in the gold mining business, Gold ETF, as well as in Physical Gold on behalf of investors.

The value of the Gold Fund depends upon the NAV of that fund. Further, a Demat account is not necessary to purchase a gold mutual fund.

Advantages of Gold Mutual Fund:

- Like other mutual funds, it is pretty easy to invest in the “Gold Mutual Fund”. Moreover, professional fund managers manage this fund.

- It’s highly liquid, so you can withdraw money anytime.

Cons of Gold Mutual Fund:

- Exit loads and fund management expenses reduce the overall investment return.

- Like other mutual funds, a gold mutual fund is also subject to market risk. The investment is not 100% in gold but also the shares of gold mining business companies and gold ETF.

#4 – Gold Exchange Traded Fund (Gold ETF):

Similar to Gold Mutual fund, It is pretty easy to invest in Gold ETF. Additionally, the gold ETF is a listed, traded, and regulated product like any other stock or share on NSE and BSE.

The fund house invests in physical gold of 99.5% purity on behalf of investors. One unit of Gold ETF is equivalent to one gram of pure gold.

Moreover, Gold ETF is a convenient way of buying gold in electronic form. Further, the price of gold ETF on a particular day is directly proportional to the cost of actual physical gold.

Pros of Gold ETF:

Here are the best things about Gold ETF:

- There are no storage and purity risks since gold is kept in paper or Demat form.

- You can take back physical gold in multiples of 1 kg as sale proceeds.

- You can liquidate your investment at any time, and it’s more tax-efficient than owning physical gold or investing in a gold fund.

- Further, the SEBI regulates the Gold ETF and is quite a safe way of investment.

- Moreover, you can use gold ETFs as collateral for taking loans.

Cons of Gold ETF:

The downside of Gold ETF is :

- Management fee and Demat charges reduce the actual return on investment.

- Gold is kept as per SEBI rules and regulations, but there is still a market risk associated with it.

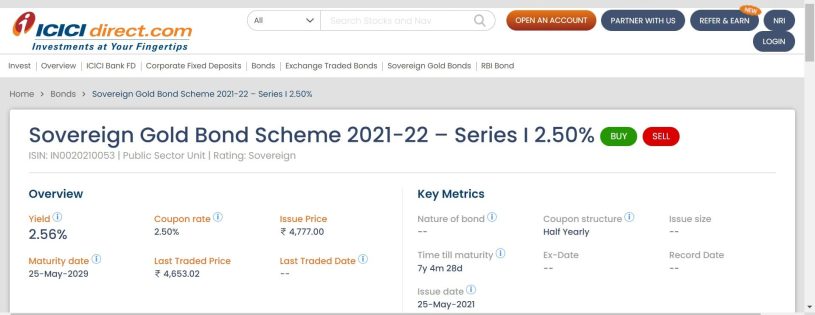

#5 – Sovereign Gold Bond (SGB):

Bond prices are directly linked to gold prices. Moreover, the quantity of gold you purchase is 999 purity and guaranteed by the Central Government.

SGB are a fantastic substitute for holding physical gold. Additionally, they carry a fixed interest rate of 2.50 per cent per annum. Moreover, You don’t pay taxes on gold’s appreciation at maturity.

The only drawback of SGB is their maturity period. The maturity tenor of the bond is eight years. Moreover, there’s a five year limit on early redemption/premature redemption. Although these bonds are traded on stock exchanges, but the trade volume is very low.

You can buy a minimum of one gram of gold through SGB. Further, the maximum quantity allowed per individual in a fiscal year is 4 Kg.

In addition to nationalized and scheduled private/foreign banks, and post offices, SGBs can also be purchased from designated stock exchanges and their authorized agents. Moreover, one can easily purchase SGBs online too.

Pros of Sovereign Gold Bond:

Here are the best things about Sovereign Gold Bond:

- It’s totally safe since the central government backs it.

- The government pays 2.5 % interest per year on this gold investment, making it unique among gold investments.

- The bonds are traded in the stock market so that they can be sold at the prevailing market price even before they reach their maturity date.

- Further, there is no purity or storage issue, and you can get a loan based on this bond from any bank.

- You don’t have to pay capital gains taxes on these bonds if you hold them for eight years.

- Nomination facility is also available.

- You can gift these bonds to friends, family, or anyone resident in India.

Cons of Sovereign Gold Bond:

Here are the weaker parts about Sovereign Gold Bond:

- The main disadvantage of the SGB gold bond is liquidity. The bond maturity period is eight years, and premature redemption is only available at the end of the 5th, 6th and 7th years.

- Although you can sell the bond in the stock exchange before maturity, the traded volume in the stock exchange is meagre, and also the traded sale price in the stock exchange is generally lower than the actual market price of gold.

Conclusion:

Now , you do not need to spend your time searching for the Gold investment options . In fact, you have a knowledge which is parallel to an expert.

To sum up, a sovereign gold bond is the best way to invest in Gold if you want to hold it for a long time. On the other hand, a Gold ETF is better than other investment options if you’re making it for a short time.

My personal choice is a Sovereign gold bond, as an investment in Gold gives a superior return over the long term.

Please leave a comment to let me know what you think of “How to Invest in Gold as an Expert: The Beginner`s Guide”.

If you want to have a personal discussion: Contact me.